Minimum wage increase in 2026 – what will be the national minimum wage and hourly rate in Poland?

From January 2026, a new minimum wage will come into force in Poland. The change in the minimum wage and hourly rate has already been announced in a regulation of the Council of Ministers and will apply to both full-time employees and persons employed under civil law contracts. Although this year’s increase is smaller than in previous years, its effects will be felt across the entire labour market – from employees’ household budgets to employment costs and remuneration planning in companies.

New rates from January

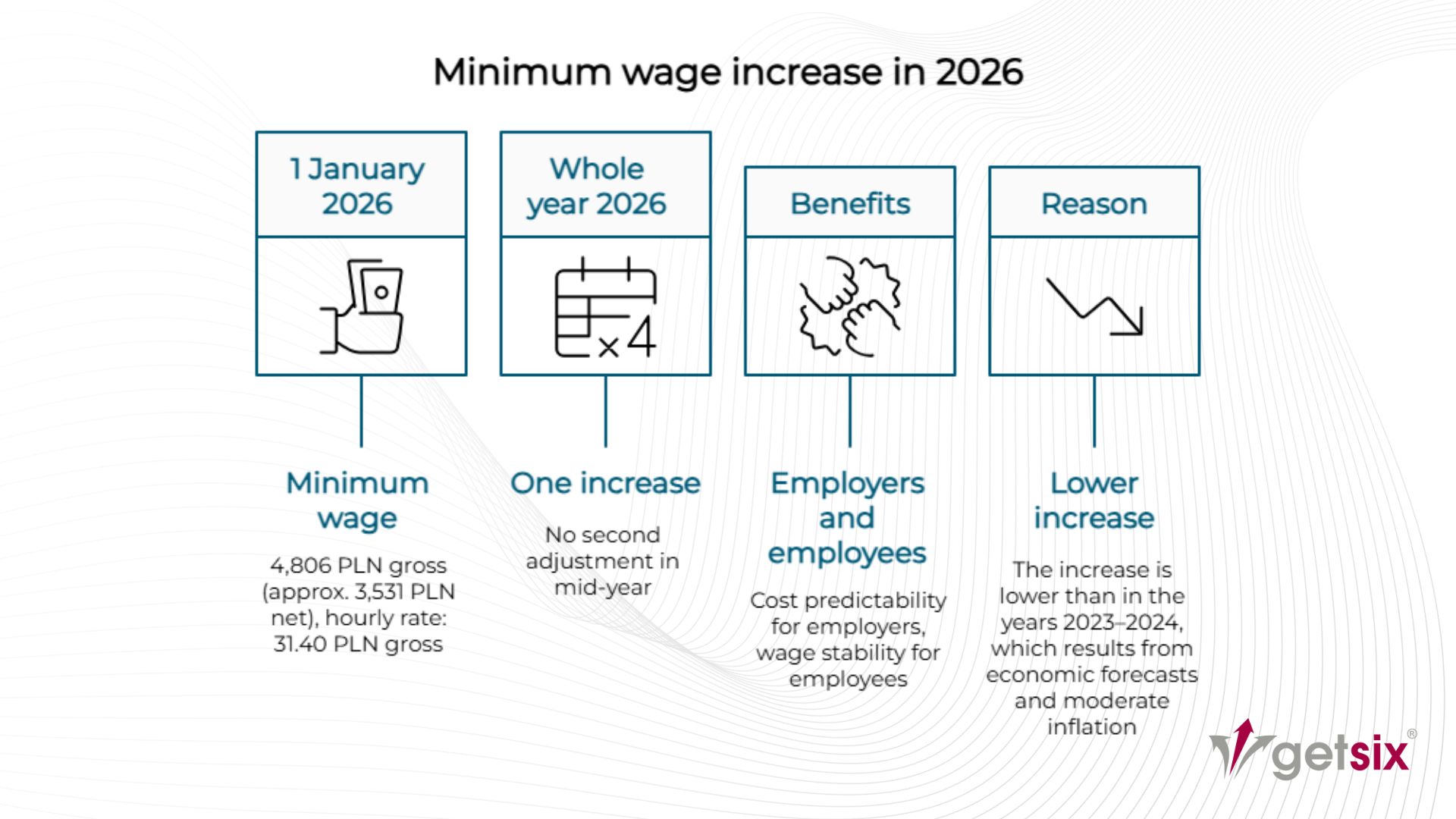

From 1 January 2026, the national minimum wage will increase to PLN 4,806 gross per month (approx. PLN 3,531 net), and the minimum hourly rate will be PLN 31.40 gross.

It is worth noting that, unlike in 2023 and 2024, next year’s minimum wage and hourly rate will remain unchanged throughout the year. No second increase is planned for the middle of the year.

This solution provides employers with greater predictability of employment costs and employees with wage stability. At the same time, the increase is significantly lower than in previous years, reflecting current economic forecasts and moderate inflation.

How is the minimum wage determined in Poland?

The minimum wage in Poland is set by the Act of 10 October 2002 on the minimum wage for work. Each year, the government prepares a proposal for new rates and submits it to the Social Dialogue Council (RDS). The RDS is composed of representatives of employers, trade unions and the government.

The parties have 30 days to reach an agreement. If a compromise is reached, the new amounts are adopted by joint decision. However, if the negotiations fail, pursuant to Article 2(5) of the Act, the obligation to unilaterally determine the minimum wage passes to the Council of Ministers.

This is what happened in 2025 – trade unionists demanded an increase in the national minimum wage above PLN 5,000, while employers proposed a symbolic increase of up to PLN 50. The lack of compromise meant that the final decision rested with the government, which had to issue a regulation by 15 September specifying the rates applicable from January 2026.

How will the increase in the minimum wage in 2026 affect employees?

The increase in the minimum wage to PLN 4,806 gross per month means that full-time employees earning the minimum wage will receive approximately PLN 3,531 net (with basic income-related costs and without tax relief).

The change is equally significant in the case of civil law contracts. From 1 January 2026, the minimum hourly rate will increase to PLN 31.40 gross, which will improve the situation of people working on contract or service contracts.

The higher minimum wage also affects:

- benefits and allowances – e.g. the night work allowance, which is calculated on the basis of the hourly rate,

- benefits and social allowances – including sickness and maternity benefits,

- the minimum pension – the amount of which is linked to the minimum wage.

Although the increase in the minimum wage in 2026 is smaller than in previous years, for over 3 million employees in Poland who receive remuneration at this level, it means a real increase in income.

The minimum wage in 2026 and employment costs in companies

The increase in the minimum wage to PLN 4,806 gross per month means higher employment costs for companies. After adding social security and health insurance contributions, the total cost of employing a minimum wage worker in 2026 will exceed approximately PLN 5,800 per month.

The increase in costs will be felt primarily by SMEs, where a large proportion of employees earn the minimum wage. Employers must also take into account:

- higher social security contributions – calculated on a new basis,

- severance pay and compensation – linked to the national minimum wage,

- tax and employee limits – e.g. amounts exempt from deductions from remuneration.

The increase in the minimum wage may force some companies to revise their remuneration policies in order to maintain appropriate wage ratios between positions. In turn, in industries with a high proportion of minimum wages, the increase in labour costs may translate into price pressure and the need to optimise employment.

How has the minimum wage in Poland grown over the last decade?

The minimum wage in Poland has been steadily increasing for many years, with some periods seeing exceptionally high increases. For comparison, in 2015, the minimum wage was PLN 1,750 gross, and from 1 January 2026, it will reach PLN 4,806 gross. This represents an increase of over 170% over a decade.

Table: changes in the minimum wage between 2015 and 2025

| Year | From 1 January | From 1 July |

|---|---|---|

| 2025 | 4 666 PLN | – |

| 2024 | 4 242 PLN | 4 300 PLN |

| 2023 | 3 490 PLN | 3 600 PLN |

| 2022 | 3 010 PLN | – |

| 2021 | 2 800 PLN | – |

| 2020 | 2 600 PLN | – |

| 2019 | 2 250 PLN | – |

| 2018 | 2 100 PLN | – |

| 2017 | 2 000 PLN | – |

| 2016 | 1 850 PLN | – |

| 2015 | 1 750 PLN | – |

An analysis of historical data shows that the growth rate in 2026 (PLN 140 gross) is one of the lowest in recent years. For comparison, in 2024, the minimum wage was increased by as much as PLN 366, and in 2023 – by PLN 590 (in total, after two increases).

Summary – what does the minimum wage increase in 2026 mean?

From 1 January 2026, the minimum wage in Poland will increase. For over 3 million people, this means higher wages, while for companies it means higher employment costs and the need to adjust their wage budgets.

It is worth remembering that the minimum wage also affects numerous benefits, contributions and tax limits, which change as the national minimum wage increases. Therefore, when planning your company’s finances for 2026, you should take into account not only the salaries themselves, but also the entire system of related charges and obligations.

getsix® supports entrepreneurs in analysing the effects of changes in labour law, HR and payroll calculations, and adapting remuneration policies to the new realities. Contact us to prepare your company for 2026.

Legal basis:

Regulation of the Council of Ministers of 11 September 2025 on the minimum wage and minimum hourly rate in 2026.

If you have any questions regarding this topic or if you are in need for any additional information – please do not hesitate to contact us:

CUSTOMER RELATIONSHIPS DEPARTMENT

ELŻBIETA NARON

Head of Customer Relationships

Department / Senior Manager

getsix® Group

***