Tax relief for Territorial Defence Force (WOT) and Active Reserve (AR) soldiers – rules for employers in Poland

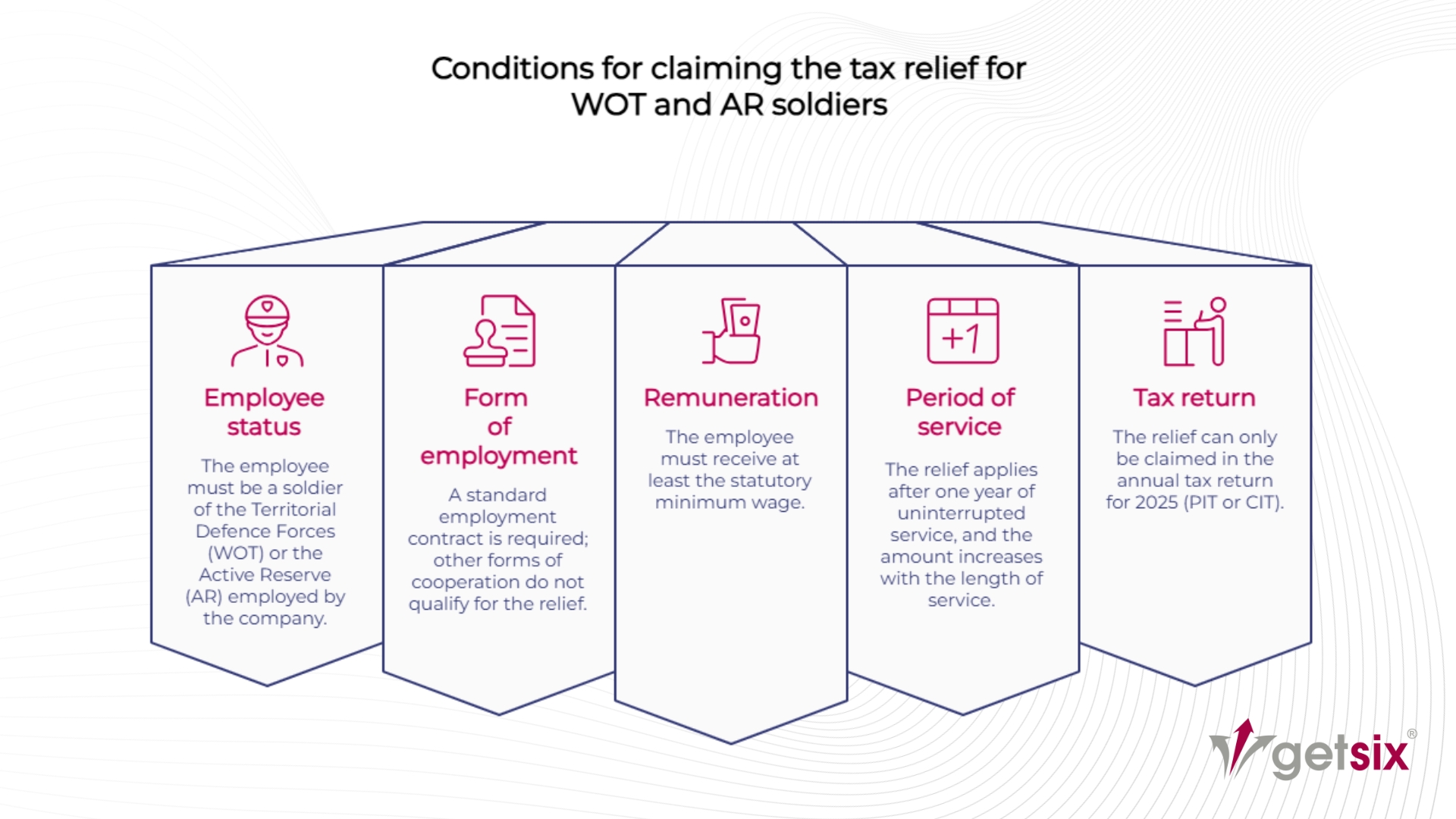

As the tax year comes to an end, it is worth reminding about a new preference that entrepreneurs will be able to take advantage of for the first time in their 2025 tax returns. The tax relief for employing soldiers of the Territorial Defence Forces (WOT) and Active Reserve (AR) provides real support for companies. It can be included in both PIT and CIT settlements – taxpayers conducting business activity taxed on general principles, on a flat-rate basis, and corporate income tax payers will benefit from it. However, in addition to the measurable tax benefits, it is worth remembering that employing soldiers also involves additional obligations on the part of the employer.

What is the tax relief for WOT and AR soldiers?

The tax relief for entrepreneurs employing soldiers of the Territorial Defence Forces (WOT) and the Active Reserve (AR) was introduced by the Act of 1 October 2024 and has been in force since 1 January 2025. It is provided for in both the PIT Act (Article 26he) and the CIT Act (Article 18eg). Its purpose is to encourage employers to support people who combine professional activity with military service by reducing their tax burden.

The relief is available to PIT taxpayers who settle their accounts on general principles or on a flat-rate basis, as well as CIT taxpayers, provided that they employ WOT or AR soldiers on the basis of an employment contract, with at least the minimum wage.

The relief does not apply to associates employed on the basis of civil law contracts or in the B2B model.

In practice, the deduction consists of reducing the tax base by a specific amount, depending on the soldier’s uninterrupted period of service. The deduction is available separately for each employed WOT or AR soldier who meets the conditions.

Deduction amounts and examples of application

The amount of the tax relief depends on the length of uninterrupted military service by a WOT or AR soldier. The deduction amounts are specified by law and apply to both PIT and CIT.

Base deduction amounts

| Length of uninterrupted service | Deduction amount per employee |

|---|---|

| at least 1 year | PLN 12,000 |

| at least 2 years | PLN 15,000 |

| at least 3 years | PLN 18,000 |

| at least 4 years | PLN 21,000 |

| at least 5 years | PLN 24,000 |

Factors increasing the relief

The legislator has provided the possibility of increasing the indicated amounts:

- 1.5 – for micro and small entrepreneurs (as defined in the Entrepreneurs Law),

- 1.2 – for other taxpayers who employ at least 5 employees (calculated as full-time positions) throughout the tax year.

Principle of proportionality

If a soldier was employed for less than a tax year, the relief is granted in the amount of 1/12 of the base amount for each full month of employment.

Examples of application

- A micro-entrepreneur employs a WOT soldier with two years of service. The base amount is PLN 15,000. Due to the status of a micro-entrepreneur, a coefficient of 1.5 is applied → PLN 22,500 deduction.

- A company employing at least 5 people throughout the year has an AR soldier with three years of service on its team. The base amount is PLN 18,000, after applying a coefficient of 1.2 → PLN 21,600 deduction.

- If a soldier is employed for 3 months in a year (with at least one year of service), a deduction of 3/12 × PLN 12,000 = PLN 3,000 is applicable.

- An entrepreneur employing several soldiers (e.g. 1 year, 2 years and 5 years of service). The deductions add up – PLN 12,000 + PLN 15,000 + PLN 24,000 = PLN 51,000 (with the possibility of increasing by a coefficient).

How to deduct the relief for WOT soldiers?

The deduction is made in the annual tax return – both in PIT and CIT – submitted for 2025. The relief does not reduce monthly or quarterly advance payments, and its amount is determined on the basis of data from the entire tax year.

What information must be provided in the declaration?

According to the Act, the declaration must include, among other things:

- the PESEL number of the soldier performing service,

- the number of months and years of uninterrupted service in the WOT or AR,

- information on the taxpayer’s status (micro-entrepreneur, small entrepreneur or employer employing at least 5 people on a full-time basis).

Documents for inspection purposes

At the request of the tax authorities, the taxpayer is required to submit:

- certificates or statements confirming the employee’s service,

- other evidence necessary to determine the right to relief (e.g. HR documentation confirming employment under an employment contract, amount of remuneration).

Limits and settlement rules

- The deduction cannot exceed the taxpayer’s income from business activity (PIT) or operating activity (CIT).

- In the event of a loss or insufficient income, the unused portion of the relief can be deducted over the next 5 tax years.

- The deduction amounts are summed up – the relief is available for each soldier who meets the conditions.

Employer obligations towards soldier-employees

Employing soldiers from the Territorial Defence Forces or Active Reserve not only means the possibility of tax relief, but also additional obligations under the Homeland Defence Act.

Call for immediate attendance

Soldiers may receive a call to immediate service. After the employee reports to the unit, the commander is required to immediately notify their employer. Regardless of this, the employee is obliged to inform the company of their absence and its expected duration – no later than on the second day of their absence.

Unpaid leave for the duration of service

According to Article 305 of the Homeland Defence Act, an employer is required to grant a soldier-employee an unpaid leave for the duration of their service. During this period, the employee retains all rights arising from their employment relationship, except for the right to remuneration. The employer cannot refuse to provide such leave.

Employee rights

During their service, employees remain in an employment relationship – they retain, among other things, the right to return to their position after completing their military duties.

Additional initiatives and support programmes

In addition to tax relief, the legislator has also provided other forms of support for entrepreneurs employing WOT and AR soldiers.

Exemption from the obligation to pay severance pay

The employer does not have to finance severance pay for employees who are soldiers who have completed basic training. This benefit is paid by the military unit in the amount of 50% of the average remuneration from the second quarter of the previous year.

Preferences in public contracts

The employment of WOT and AR soldiers may be an additional quality criterion when awarding public contracts below EU thresholds. This gives entrepreneurs who support national defence a better chance of winning contracts.

The ‘WOT-Friendly Employer’ programme

The Ministry of National Defence also runs a programme that recognises companies that provide special support to their soldier employees. The ‘WOT-Friendly Employer’ competition promotes good practices in flexible work organisation and raises awareness of the role of the WOT. Companies can count on prestigious awards and additional training to support their staff in combining their professional and military duties.

The tax relief for employing WOT and AR soldiers is a real support for entrepreneurs – it allows them to reduce their tax base in both PIT and CIT, and in practice translates into measurable tax savings. At the same time, employers must remember that employing soldiers entails certain HR obligations that cannot be overlooked.

Therefore, it is worth preparing HR procedures related to the absence of employees called up for service and to ensure that the appropriate tax documentation is in place.

getsix® supports entrepreneurs both in calculating tax relief and settlements, as well as in preparing HR documentation, so that the use of preferences is safe and compliant with regulations. Contact us.

Legal basis:

Act of 1 October 2024 amending certain acts to support entrepreneurs employing Territorial Defence Force soldiers or Active Reserve soldiers

If you have any questions regarding this topic or if you are in need for any additional information – please do not hesitate to contact us:

CUSTOMER RELATIONSHIPS DEPARTMENT

ELŻBIETA NARON

Head of Customer Relationships

Department / Senior Manager

getsix® Group

***