Switching to Estonian CIT in Poland requires timeliness – even a minor delay may disqualify a taxpayer

Estonian CIT is a preferential corporate tax regime available in Poland, offering a simplified way to settle accounts with the tax office and reduce accounting obligations. Its benefits are substantial — tax deferral on reinvested profits, fewer formalities, and improved liquidity.However, switching to this regime requires strict compliance with formal obligations — especially the timely signing of the financial statements. Even a one-day delay may result in the loss of the right to use the Estonian CIT.

Switching to Estonian CIT is a way to streamline tax settlements and achieve a more favourable taxation model. However, it is also a minefield of formalities. Businesses that fail to meet any of the required conditions — for example, by signing their financial statement after the deadline — lose the right to apply this regime, even if they filed the ZAW-RD form in good faith and started reporting under Estonian CIT. The Polish tax authority applies a strict approach, and the consequences can go back several years.

Who can benefit from the Estonian CIT?

In order to use the Estonian CIT scheme, a company must meet several conditions set out in the Polish Corporate Income Tax Act. These include not only legal form requirements but also restrictions on ownership structure, business activity and employment. Meeting these conditions is essential both at the entry stage and for remaining in the regime.

Legal form and Estonian CIT – which companies qualify?

Estonian CIT in Poland is available to capital companies (limited liability companies and joint-stock companies) and, since 2022, also to simple joint-stock companies, provided all shareholders are natural persons.

Since recent changes, limited partnerships and limited joint-stock partnerships may also opt in — as long as all their shares or interests are held by natural persons.

Shareholding structure

- No legal persons (e.g. other companies) can be shareholders.

- The company may not be part of a tax capital group.

Employment and Estonian CIT – what are the requirements?

The company should employ at least 3 persons (excluding shareholders) under employment contracts or other equivalent contracts considered for this requirement.

There are some exceptions and transitional periods, allowing lower employment thresholds in the initial years, provided employment increases over time.

Revenue thresholds

Currently, there is no revenue cap preventing access to Estonian CIT. (Initially, a revenue limit of PLN 100 million applied, but it has been repealed.)

Other requirements

The company must keep its accounting records in compliance with the Polish Accounting Act (full accounting).

Most of its income should not come from financial activities. Reinvesting profits is encouraged, as it positively affects the effective tax rate, although it is not a formal obligation.

Entities applying International Financial Reporting Standards (IFRS) are excluded from Estonian CIT, as these standards are not allowed under this model.

Meeting these requirements is only the starting point. Crucially, the process of transitioning to Estonian CIT must be properly documented and carried out on time.

Additional exclusions

Estonian CIT in Poland is not available to, among others: banks, credit unions, companies in liquidation or bankruptcy, and entrepreneurs operating within Special Economic Zones. Therefore, there is an additional set of statutory exclusions that must be taken into account.

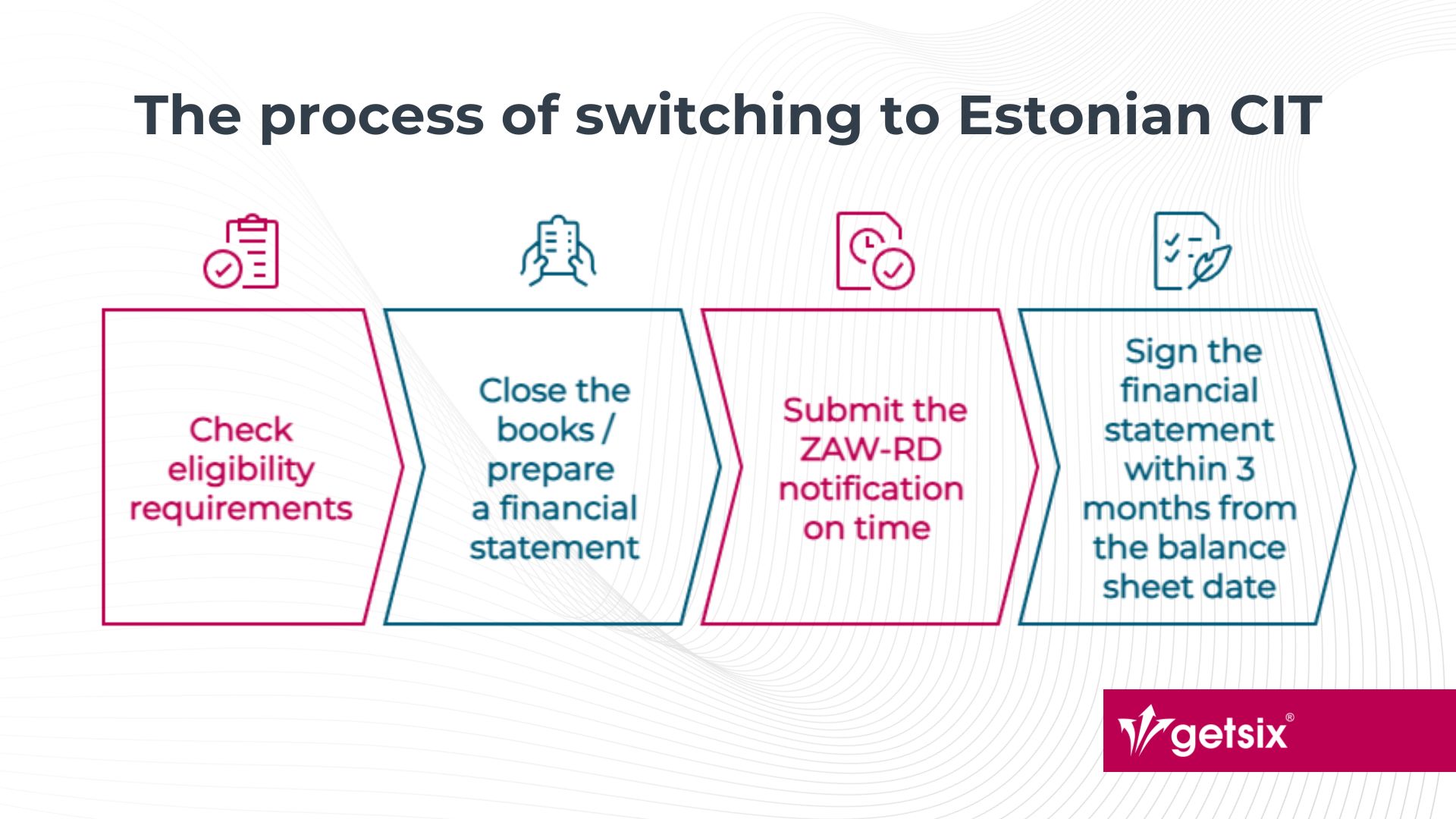

Switching to Estonian CIT – two scenarios, two sets of obligations

Polish law provides for two possible moments to switch to Estonian CIT: either at the beginning of the tax year or during the course of the year. Depending on the option selected, the taxpayer is subject to slightly different formal and accounting obligations.

1. Switching to Estonian CIT at the beginning of the tax year:

- The ZAW-RD notification must be submitted by the end of the first month of the new tax year (e.g. by 31 January if the tax year coincides with the calendar year).

- There is no requirement to close the accounting books in advance or to prepare an additional financial statement.

- The financial statement for the previous year must be prepared and signed in accordance with the general rules set out in the Polish Accounting Act – that is, within 3 months of the balance sheet date (typically by 31 March).

2. Switching during the tax year:

- The accounting books must be closed as of the last day of the month preceding the first month of lump-sum taxation.

- A financial statement must be prepared as of that date, which should:

- be in electronic format,

- be signed by the company’s director and the person responsible for the accounts,

- be signed no later than 3 months from the balance sheet date.

- The ZAW-RD notification must be submitted by the end of the month in which lump-sum taxation is to begin.

Interpretation of the National Tax Information – even a one-day delay may invalidate the switch to Estonian CIT

According to the interpretation issued by the Polish National Tax Information Office on 14 February 2025 (ref. 0114-KDIP2-2.4010.675.2024.2.IN), even signing the financial statement exactly one day after the deadline disqualifies the company from applying Estonian CIT. The tax authority clearly stated:

“The mere preparation of the financial statement (without its proper signing) is not sufficient to make a valid election of the lump-sum taxation.”

This means that the signature is considered an integral part of the financial statement preparation process – it cannot be treated as a mere formality.

Example:

This is well illustrated by the case of a company that intended to apply Estonian CIT from February. The books were properly closed as of 31 January, and the financial statement was prepared within the required timeframe. The issue arose at the signing stage: the document was signed electronically on 29 May – exactly one day after the deadline of 28 May. Although the entire transition was thoroughly documented and carried out in good faith, the National Tax Information Office deemed the election ineffective, and the company lost the right to apply Estonian CIT.

The authority explained that signing the statement after the statutory deadline meant the financial statement was not prepared in accordance with the Accounting Act – and thus the condition laid down in Article 28j(5) of the Polish Corporate Income Tax Act was not fulfilled.

Ministry of Finance: the signature date is decisive

The Polish Ministry of Finance confirmed this strict approach in its general interpretation of 25 January 2024, as well as in a response to a parliamentary question dated 16 January 2025. It was emphasised that the decisive factor is the date on which all required individuals sign the statement – not merely when it was prepared.

This position is also supported by national accounting standards: the date of preparation of the financial statement is considered to be the date on which the last required electronic signature is affixed (KSR 14, point 3.15).

What are the consequences for companies that miss the deadline?

Failure to comply with formal deadlines — even unintentionally — may result in serious tax consequences. In the case of Estonian CIT, it is not only about losing the right to lump-sum taxation, but also about the financial consequences of incorrect tax settlements:

- tax returns filed under the lump-sum system may be deemed incorrect — resulting in tax arrears,

- such arrears may apply retrospectively for several years if the irregularity is identified later,

- statutory interest and potential fiscal penalties may be added to the outstanding amount.

From the perspective of the Polish tax authorities, it is irrelevant whether the failure was caused by a mistake or lack of knowledge — what matters is compliance with the law. That is why the transition to Estonian CIT must not only be well planned, but also flawlessly documented.

How to avoid mistakes?

To minimise the risk of having the right to lump-sum taxation challenged, it is essential to exercise particular diligence at every stage of the procedure. In practice, this means following a few key organisational and documentation-related principles:

- the accounting books should be closed well in advance, and the financial statement should be prepared without delay,

- the document must be signed on time by all required persons — the company’s director and the person responsible for the accounts,

- the timeline should account for the fact that deadlines falling on weekends or public holidays are not extended,

- the entire process must be properly documented — especially with regard to the dates of signatures, the submission of the ZAW-RD notification, and any correspondence with the tax authorities.

Even minor procedural errors may result in the Estonian CIT election being considered invalid. Accuracy and full compliance with the statutory requirements are essential for maintaining tax security.

Estonian CIT is undoubtedly an attractive alternative to the traditional taxation model — particularly for companies that reinvest profits and value simplification in tax compliance. The benefits of tax deferral, reduced administrative burden, and improved financial liquidity are clear and measurable.

However, the conditions for entering and remaining in the regime are strictly defined, and failure to meet even a single requirement — especially with regard to timely book closure and signing of the financial statement — results in a complete loss of the right to apply lump-sum taxation.

Therefore, the decision to switch to Estonian CIT should be preceded by a thorough analysis, a carefully planned timeline of actions, and access to professional support. Working with an experienced tax advisor and accounting team helps minimise the risk of errors and increases the likelihood of fully benefiting from this taxation model.

If you are considering switching to Estonian CIT or need to verify whether your company meets the formal requirements, it is highly advisable to consult with a team of tax professionals experienced in handling such processes. getsix® offers comprehensive support — from eligibility assessment and documentation preparation to ensuring ongoing compliance throughout the application of the Estonian CIT regime.

If you have any questions regarding this topic or if you are in need for any additional information – please do not hesitate to contact us:

CUSTOMER RELATIONSHIPS DEPARTMENT

ELŻBIETA NARON

Head of Customer Relationships

Department / Senior Manager

getsix® Group

***