Transfer pricing in Poland in 2025 – thresholds, limits and documentation

Transfer pricing in Poland in 2025 remains a focus for both tax authorities and businesses engaging in transactions with related entities. The regulations in this area are crucial for maintaining financial transparency, avoiding disputes with the tax office and minimizing the risk of penalties. In 2025, the rules continue to impose strict documentation requirements and provide for severe penalties for non-compliance, which is why many companies choose to seek professional support in the field of transfer pricing.

Transfer pricing – who do the regulations apply to?

The transfer pricing regulations cover controlled transactions of a homogeneous nature between related entities – both domestic and cross-border. The documentation obligation arises once the transaction value exceeds the thresholds specified in the legislation. The purpose of the documentation is to demonstrate that prices were set on an arm’s length basis, as they would be between unrelated parties.

In addition to standard transactions, special attention is paid to dealings with entities in so-called tax havens, which have lower threshold limits and require additional business justifications.

Read more:

- Tax havens not included in the list of countries and territories engaging in harmful tax competition – announcement by the Polish Minister of Finance of 8 March 2025

- New list of countries and territories engaging in harmful tax competition

Documentation thresholds and limits in 2025

The documentation thresholds are determined separately for each homogeneous transaction and separately for the cost and revenue sides.

| Type of transaction | Documentation threshold |

|---|---|

| Goods | PLN 10 000 000 |

| Financial | PLN 10 000 000 |

| Services | PLN 2 000 000 |

| Other | PLN 2 000 000 |

For transactions with entities in tax havens:

- PLN 2 500 000 – financial transaction

- PLN 500 000 – non-financial transaction

How is the transaction value determined?

Depending on the type of operation, this may be the capital value (loans, credits), nominal value (bond issuance), guarantee amount (sureties), allocated revenues/costs (foreign branches), or the value appropriate for the given type of transaction.

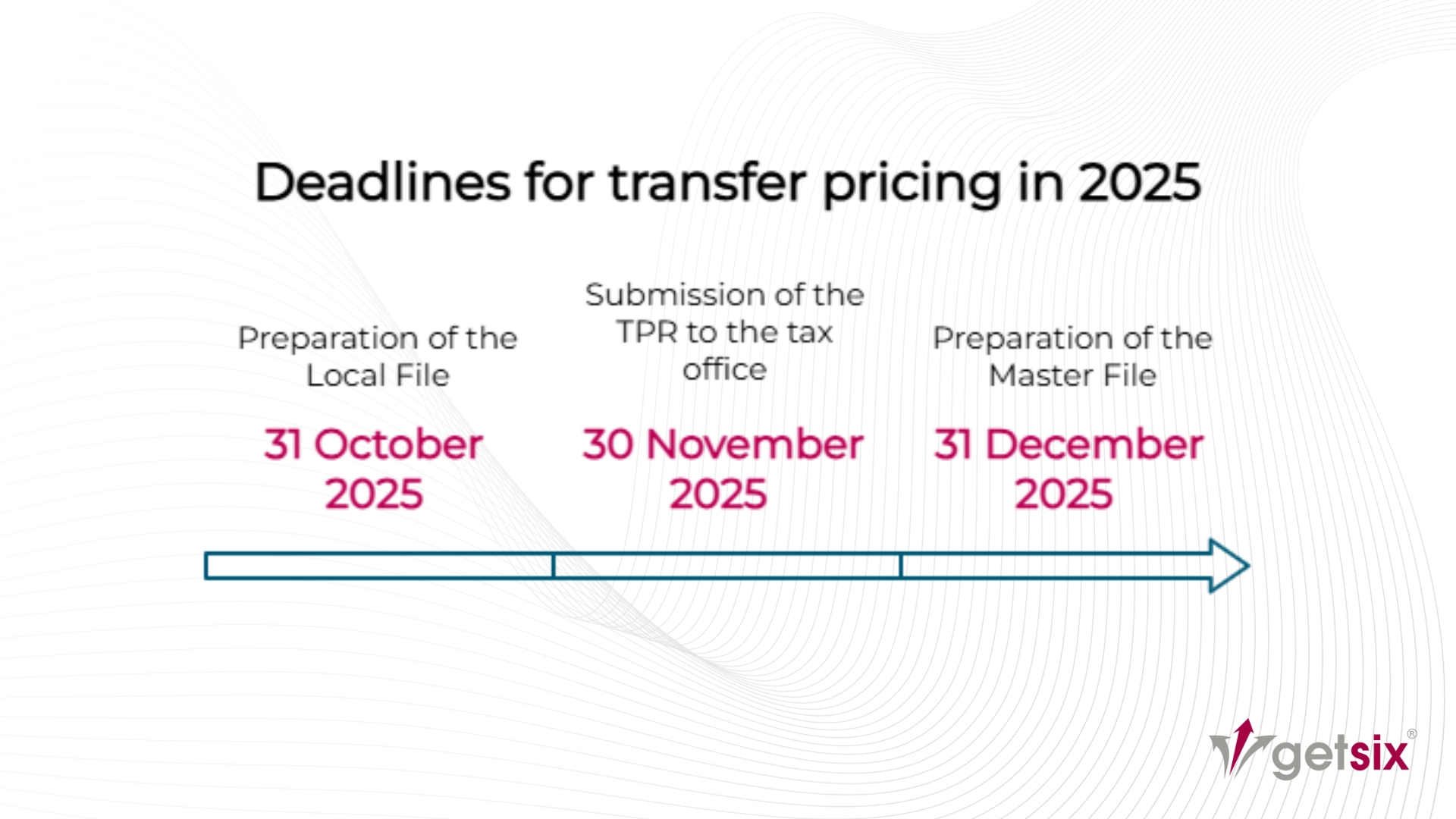

Deadlines for transfer pricing in Poland in 2025

For taxpayers with a calendar-year tax year, the following deadlines apply:

- 31 October 2025 – preparation of the Local File (local transfer pricing documentation)

- 30 November 2025 – submission of the TPR (Transfer Pricing Report) to the tax office

- 31 December 2025 -preparation of the Master File (for capital groups with consolidated revenues exceeding PLN 200 million)

For companies whose tax year does not coincide with the calendar year – by the end of the 10th, 11th, and 12th month, respectively, after the end of the tax year.

Elements of the local transfer pricing documentation

Transfer pricing rules in 2025 require that local documentation include, among other things:

- Detailed description of the related entity

- Characteristics of the transaction (functions, risks, assets)

- Comparative analysis or compliance analysis

- Description of the pricing method used

- Financial information

- Business justification for transactions with tax haven entities

Additionally, documentation must be prepared and stored in electronic form, as required by current regulations.

Exemptions from the documentation obligation

Not every related-party transaction in 2025 requires documentation. Exemptions include, among others:

- Transactions between Polish related entities that have not incurred a tax loss

- Selected financial transactions and low value-adding services, subject to safe harbour conditions

- Certain cost allocations with unrelated parties without a profit markup

- For micro and small enterprises, an exemption from preparing a comparative or compliance analysis (but not from the entire Local File)

Sanctions for non-compliance

Failure to comply with transfer pricing obligations in 2025 entails serious consequences:

- No Local File – penalty up to 720 daily rates, depending on the minimum wage

- Incorrect data in the TPR – penalty up to 720 daily rates

- No Master File – risk of additional sanctions and audits

How to prepare for transfer pricing in 2025?

- Analyse the documentation thresholds

- Gather key documents

- Prepare a well made comparative analysis

- Carefully prepare and review the TPR

- Plan the work schedule

Start by checking whether your transactions exceed the statutory limits. Remember, the value is determined separately for each homogeneous transaction and separately for costs and revenues. This will help you avoid unexpected documentation obligations.

Collect all data and materials relating to the transactions: contracts, invoices, pricing calculations, descriptions of the transaction subject, and economic analyses. This is the foundation for your Local File and TPR.

Verifying the arm’s length nature of prices is a key element of the documentation. The benchmarking or compliance analysis should be based on current data and tailored to your industry specifics. A well-prepared analysis can protect against tax authority challenges.

The Transfer Pricing Report must be fully consistent with the data in the Local File. Even minor discrepancies can trigger a tax audit, so an internal review before submission is advisable.

Do not leave documentation preparation to the last minute. Set interim deadlines for each stage – from data collection to analysis preparation and final review. Working in advance minimizes the risk of errors and time pressure.

Preparing transfer pricing documentation in Poland requires time, precision, and knowledge of current regulations. The earlier you start, the better your chances of avoiding mistakes and penalties. Contact us to ensure full support and tax compliance.

Transfer pricing in 2025 remains one of the most important areas of tax audits in Poland. Meeting deadlines is key, but so is properly preparing documentation in line with legal requirements. Proper process management – including a comparative analysis and compliance with the arm’s length principle – will help avoid high penalties and disputes with the tax administration.

Legal basis:

- Regulation of the Minister of Finance of 29 August 2022 on transfer pricing information in the field of corporate income tax (Journal of Laws 2022, item 1934)

- Regulation of the Minister of Finance of 29 August 2022 on transfer pricing information in the field of personal income tax (Journal of Laws 2022, item 1923)

If you have any questions regarding this topic or if you are in need for any additional information – please do not hesitate to contact us:

CUSTOMER RELATIONSHIPS DEPARTMENT

ELŻBIETA NARON

Head of Customer Relationships

Department / Senior Manager

getsix® Group

***